Blog post

5 global holiday shopping trends to drive advertising success in 2025

As the 2025 winter holidays draw closer, shoppers are gearing up for a dynamic season, with growing interest in major sales events. Yet concerns about lingering economic uncertainty underscore the need for advertisers to understand consumer mindsets and develop strategic plans.

The latest Microsoft Advertising research on global markets offers a look at what consumers plan to buy and how they intend to navigate the season’s pressures, trade-offs, and surprises.

Explore these insights to help develop an early holiday advertising strategy that will drive sales, increase conversions, and delight customers.

1. Sales events continue to rise globally

Consumers are excited about the season ahead, with many planning to start early and make the most of major promotional moments. Forrester notes that today’s consumers are seeking value in the purchases they make, and that’s expected to extend into the holidays.

Microsoft Advertising research shows that 85% of U.S. shoppers plan to take part in significant sales events this year—a trend that’s being seen worldwide. In the U.K., 76% of consumers plan to participate in sales (up from 68%), and in Australia, it’s risen from 71% to 81%.1

While Black Friday remains the cornerstone, interest in Cyber Monday and Small Business Saturday has been gaining traction.2 Advertisers that start early and have major promotions planned around traditional shopping days are well-positioned to reach customers. Winning campaigns that offer deeper discounts, customer loyalty rewards, and creative that’s customized to a variety of customer profiles can help drive conversions this holiday season. Shoppers aren’t waiting, and neither should you.

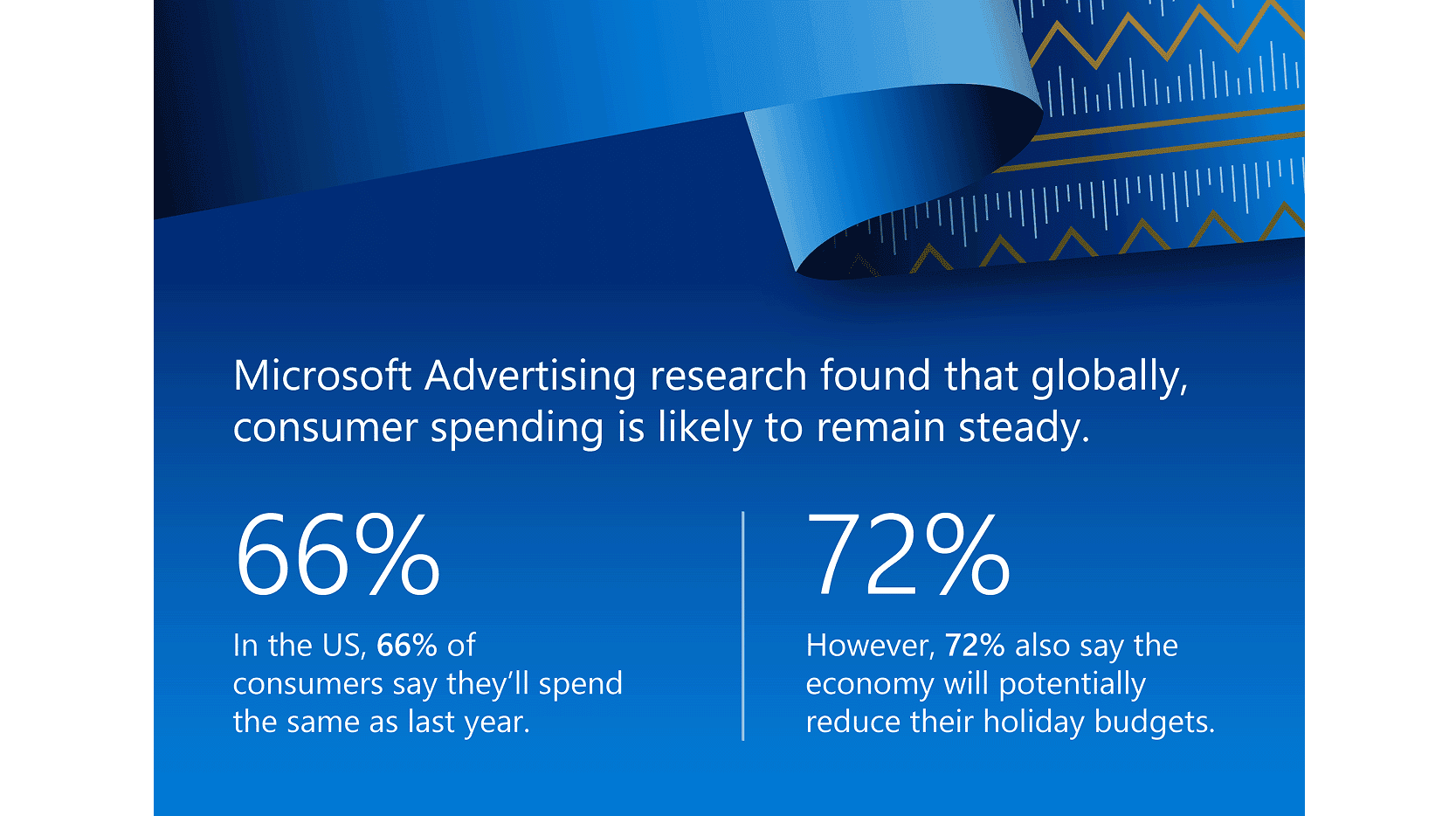

2. Budget consistency meets economic caution

While enthusiasm remains high, economic concerns are driving consumers to look for bargains. Deloitte notes that 72% of consumers are concerned about rising costs, citing factors like inflation, tariffs, and increases in the general cost of living.

Brands will want to monitor U.S. markets to quickly adapt to customers’ behaviors. Microsoft Advertising's AI-powered solutions can help you stay ahead by surfacing meaningful insights in real time, so you can meet shoppers where they are with messages that resonate. Brands may choose to lean into discount-focused messaging in the U.S. or reprioritize other markets as conditions continue to evolve.

3. Travel intent diverges by market

Another shift that’s underway is whether the holidays signal travel or cozy plans at home. For the first time since 2021, fewer Americans plan to hit the road at just 34% of our survey respondents.5 By contrast, more consumers in the U.K. and Australia plan to travel this year compared to last.6

In markets with increased travel, there’s an opportunity to get consumers excited about gifts that are easy to transport. Where travel is down, buyers are likely to be interested in flowers, gift baskets, gift cards, and other ways to celebrate from afar. For marketers, this increases the flexibility to tailor spending. Intelligent audience tools and generative AI solutions make it possible to localize creative and optimize spend by market with ease.

4. Price sensitivity drives search and discovery

The way we think of deals is changing, too, moving from a sales-closing tactic to a key factor in discovery. In our research, 77% of U.S. shoppers say they’re paying more attention to prices, and 74% are actively investing time to find deals.7 It’s easy to see why: McKinsey notes that rising costs of goods top consumer concern across 18 markets, with many deal hunting, trading down to cheaper items or generics, and delaying purchases to stretch their dollars.

Microsoft Advertising research shows similar trends that can help advertisers meet cost-conscious consumers where they are. Forty-one percent of buyers begin researching days ahead of a sales event, and search is where they go first for price comparisons and product info.8

Microsoft Advertising helps drive discovery and conversion with Shopping campaigns, Responsive Search ads, Dynamic Search ads along with Audience targeting.

5. Gifting behaviors reflect cultural and generational shifts

Even the “who” of gifting is evolving and reshaping the season’s social dynamics.

Advertisers must adjust to changing shopping habits to meet consumers where they are. In the U.S., online shopping will hit an all-time high, while other markets favor mobile-forward hybrid shopping plans.11 Across the globe, a strong seasonal advertising plan for digital channels is going to be key in the months ahead.

Advertisers should seize this opportunity to diversify messaging and creative, using Performance Max, to make it easier to tailor creative and sentiment for highly personalized and relevant ads throughout the consumers shopping journey.

Celebrate Smarter with Microsoft Advertising

The holidays may be high-stakes, but they don’t have to be high-stress. While consumer preferences and plans are evolving, we can equip you with the insights and tools to reach them.

Whether you're tapping into conversational AI to streamline planning, accessing premium inventory across our owned-and-operated properties, or using generative AI to create effective holiday creative, we’re ready to help. Let’s deliver more joy, greater relevance, and better results together this holiday season.

Ready to start planning your smartest season yet? Join us for our upcoming holiday webinar series, designed to provide you with valuable insights and strategies for the 2025 retail season. Click here to register and secure your spot today.

Get in touch with your Microsoft Advertising representative or schedule a consultation with our team of experts today.

Advertisers must adjust to changing shopping habits to meet consumers where they are. In the U.S., online shopping will hit an all-time high, while other markets favor mobile-forward hybrid shopping plans.11 Across the globe, a strong seasonal advertising plan for digital channels is going to be key in the months ahead.

Advertisers should seize this opportunity to diversify messaging and creative, using Performance Max, to make it easier to tailor creative and sentiment for highly personalized and relevant ads throughout the consumers shopping journey.

Celebrate Smarter with Microsoft Advertising

The holidays may be high-stakes, but they don’t have to be high-stress. While consumer preferences and plans are evolving, we can equip you with the insights and tools to reach them.

Whether you're tapping into conversational AI to streamline planning, accessing premium inventory across our owned-and-operated properties, or using generative AI to create effective holiday creative, we’re ready to help. Let’s deliver more joy, greater relevance, and better results together this holiday season.

Ready to start planning your smartest season yet? Join us for our upcoming holiday webinar series, designed to provide you with valuable insights and strategies for the 2025 retail season. Click here to register and secure your spot today.

Get in touch with your Microsoft Advertising representative or schedule a consultation with our team of experts today.

[1] 2025 Consumer Trends Holiday Research, US, n=999; UK, n=500; AU, n=3012.

[2] 2025 Consumer Trends Holiday Research, US Only 2024, n=1001; 2025, n=999, Gen Z n=147, Millennial n=336, Gen X n=340, Boomer n=176.

[3] 2025 Consumer Trends Holiday Research, US, n=999; UK, n=500; AU, n=301.

[4] 2025 Consumer Trends Holiday Research , US Only 2025, n=999.

[5] 2025 Consumer Trends Holiday Research, US, n=999; UK, n=500; AU, n=301.

[6] 2025 Consumer Trends Holiday Research, Total respondents N=999.

[7] 2025 Consumer Trends Holiday Research, Total respondents N=500.

[8] 2025 Consumer Trends Holiday Research, US Only 2025; 2024, base sizes vary based on previous shopping at each retailer *indicates low base size, under 50.

[9] 2025 Consumer Trends Holiday Research, US Only 2021, n= 1023; 2022, n=1019; 2023, n=1015; 2024, n=1001; 2025, n=999.

[10] 2025 Consumer Trends Holiday Research, US Only 2025, n=999.

[11] 2025 Consumer Trends Holiday Research, Shop during major shopping events US Only 2023, n=840; 2024, n=810; 2025, n=850. Arrow indicates significant difference from previous year at a 95%CI.

Your input makes us better

Take our quick 3-minute survey and help us transform your website experience.